What is your customer retention rate?

The percentage of existing customers who remain clients after a specific period is referred to as the customer retention rate.

In some cases, customer retention begins with the initial contact. Customers can “like” your Facebook page or join your email list. The connection will remain until they unfollow your page or unsubscribe from your mailing list.

Generally speaking, however, customer retention starts at the moment where you acquire your customer — i.e. when they buy your product.

What is considered a good customer retention rate?

Of course, the ideal retention rate is as near to 100% as possible, but greater than 95% is also an excellent place to be. This signifies that your company keeps high customer satisfaction. A realistic and ‘healthy’ retention rate, however, varies based on the business model, the size of the business and the industry in which it works.

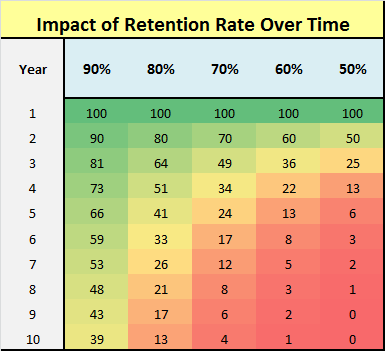

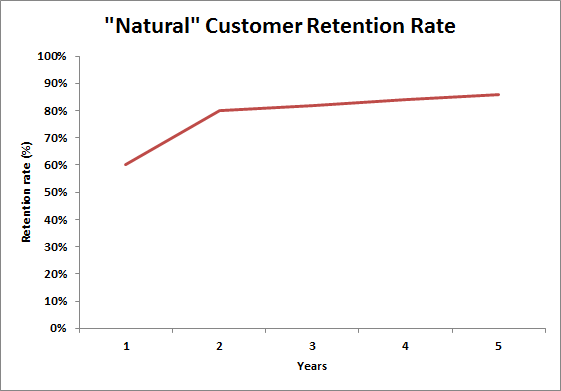

Source: CLV Calculator

The age of your organization may also determine your customer retention rate — a more established service in its market may have greater customer retention rates since it is a well-known service, and clients know what to expect from it. On the other hand, a newer company may see lower retention rates as wave after wave of new customers try out the service to learn more about it and then leave.

Source: CLV Calculator

Customer retention rate by industry

The average customer retention rate is 75%. Here’s how it breaks down by industry:

- Media: 84%

- Professional Services: 84%

- Automotive & Transportation: 83%

- Insurance: 83%

- IT Services: 81%

- Construction & Engineering: 80%

- Financial Services: 78%

- Telecommunications: 78%

- Healthcare: 77%

- IT & Software: 77%

- Average Retention Rate 75%

- Banking: 75%

- Consumer Services: 67%

- Manufacturing: 67%

- Retail: 63%

- Hospitality, Travel, Restaurants: 55%

Source: Exploding Topics

Why should you track your retention rate?

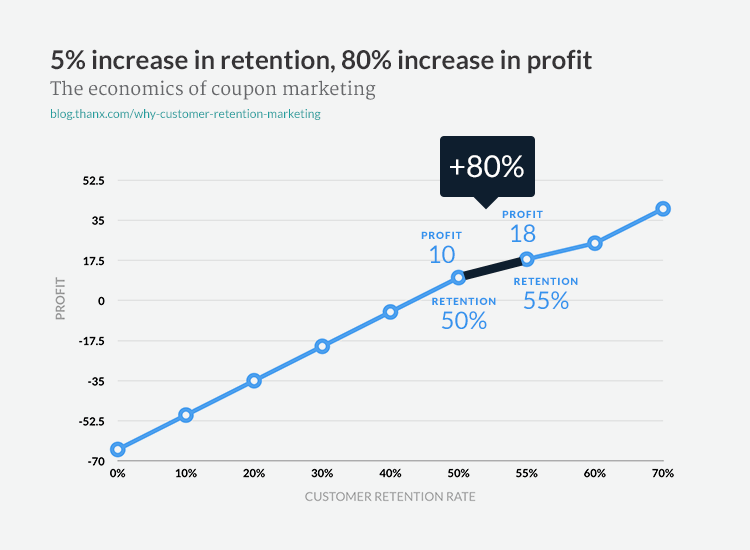

Client retention is easier and less expensive than customer acquisition. Customers who return spend more, buy more frequently, and are more likely to suggest your products and services to friends and family. On top of that, increasing customer retention may boost your bottom line — a 5% retention rate increase could lead to as much as a 95% increase in revenue.

Source: Thanx

Customer retention is crucial to a subscription company’s growth and success for several reasons:

- Effectiveness: Acquiring a new customer is 6 to 7 times more expensive than retaining an existing one.

- Maintaining loyalty: Loyal customers buy more frequently and spend more money than new customers. They recognize the worth of a product or service and are more likely to buy again and again.

- Referrals: Happy, loyal customers are more inclined to recommend your company to their friends and family, bringing in new free customers with 0 acquisition cost to you.

The idea that ‘businesses should want to keep their customers’ may seem obvious, but when you begin to develop fast and struggle to create a good long-term retention strategy, customers can slip away between the cracks.

How to calculate your customer retention rate

- Start with the number of customers at the end of a given time period

- Subtract the new customers acquired within this time period

- Divide the result by the number of customers at the beginning of this time period

- Multiply by 100

Customer retention rate formula

To calculate your CRR, use the following formula, inputting the metrics you’ve acquired in the previous section.

Customer retention rate = [(customers you end with – new customers)/customers you started with] x 100.

Or in a more compact form: CRR = [(E-N)/S] x 100

CRR calculation example

Let’s say you have 110 customers at the start of one month. During that period, you lost 8 customers but gained 21 new ones. This means you have 102 of your original customers and 123 customers at the end of the period.

Let’s assign these numbers of customers to the variables for better clarity:

E = 123

N = 21

S = 110

Now we will input those numbers into the formula:

CRR = ((E-N)/S) x 100

CRR = ((123-21)/110) x 100

CRR = 92.72%

And there you have it! Your retention rate for that period was 92.72%. Just make sure that you are using the same time period for every metric.

Retention rate vs churn rate

While the concept behind both scores is different, both scores can indicate customer happiness. The churn rate calculates the percentage of customers lost, while the retention rate represents the percentage of customers that stay with you for the given time period. Businesses want to get as near to one extreme as feasible in both circumstances, i.e. 0% churned and 100% retained customers.

How often should I calculate my customer retention rate?

Great question!

When you first calculate your customer retention rate, it’s easy to become obsessed with it. Consider, however, that in most cases, day-to-day or even week-to-week fluctuations in retention will not tell you anything. Customer retention should be already on your radar if you’re currently reporting on the rest of your company KPIs on a monthly basis, so that’s a good frequency to start with.

In general, though, it is preferable to consider a longer time horizon. Quarterly customer retention reviews can help you identify broad customer patterns, but yearly churn analysis can assist you in evaluating your year-over-year success. Quarterly and yearly variations in retention rate can also assist you in determining whether your long-term client retention initiatives are effective.

Five examples of how to improve customer retention rates

Getting a grasp on customer retention data is the first step for every organization that wants to enhance client retention, lower customer churn rate, and set smart pricing. When a company knows the correct KPIs, it is simpler to match marketing and customer service with its overall customer retention strategy. Here are a few examples of approaches you can take to retain more customers.

Example 1: Make it easy for people to reach you

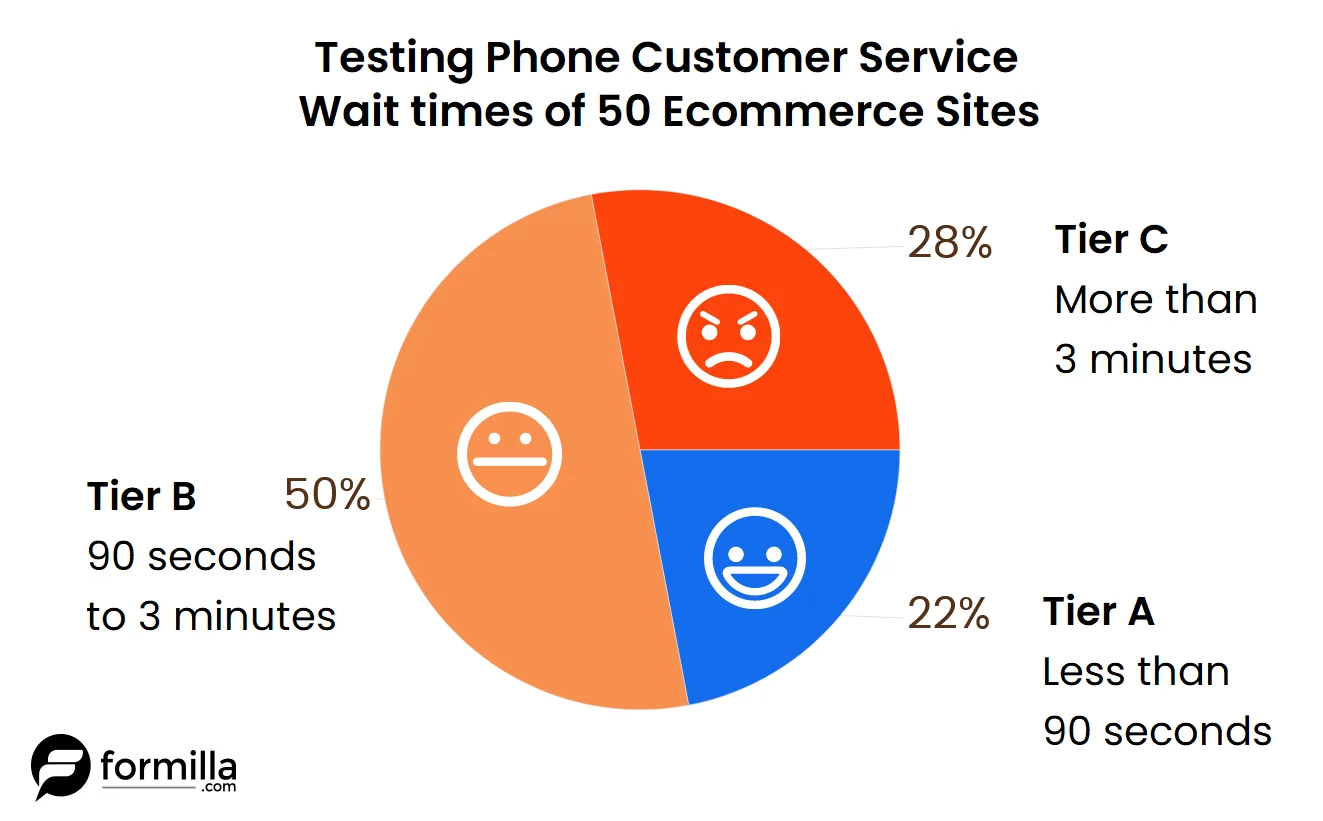

Consider the last time you had a bad customer experience with a business. There’s a strong possibility it was because you couldn’t reach a person on the phone. In fact, poor customer service is one of the leading causes of high customer churn rates.

If customers have to wait for ages in the queue, they will eventually get enraged and leave.

Source: Formilla

Spending time engaging with your customers will tell you about their true needs. The more you do this, the more easily you will be able to provide them with products or service alternatives that truly fulfill their desires. This will be extremely beneficial as you work to enhance customer service standards.

Consider how your team members successfully work together to provide individualized service:

- Recruiting team members with customer-orientated personalities.

- Making customers feel comfortable by greeting them.

- Responding in a manner consistent to the customer’s personality and lifestyle.

- Referring to your customers by their names.

- Asking open-ended questions to determine their requirements.

- Demonstrating genuine interest in the customer and their trouble.

- Showing empathy when a customer has a tough or negative experience.

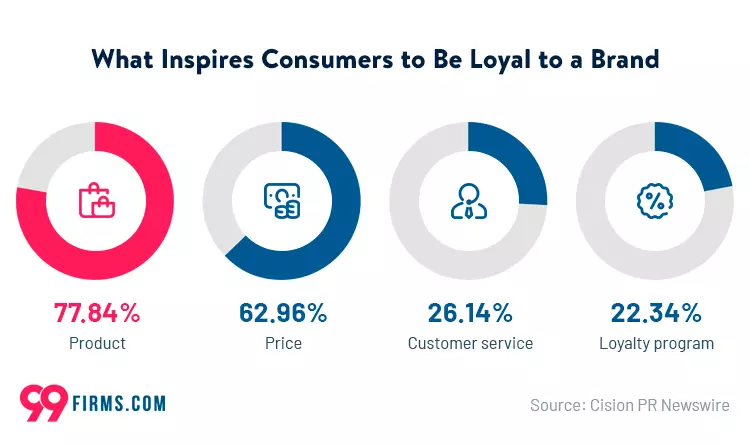

Example 2: Understand customer expectations and provide exactly what they want

Understanding what your customers expect from you is one of the most important aspects of starting a subscription business. Get started by researching your competition and case studies, but also consider developing your own survey.

Source: 99 Firms

How to get customer feedback:

- Read customer reviews, social media comments, and responses to blog posts

- Review customer service interactions

- Conduct targeted surveys

Obtaining firsthand information is crucial, and an incentive always helps.

You could try enticing subscribers to take part in your survey by providing free samples of your higher-tier products, a free trial of one of your other offerings, or a discount on their current plan.

A customer study is required to determine what customers truly desire. This entails gathering data on customer behavior and making sense of it. It also entails reviewing consumer feedback and communication.

Speaking with clients and prospects and collecting their input should help you understand what they want from your brand.

Customer desires may be divided into several categories. The primary regions of desire are:

- Product design and functionality

- Customer service

- Overall experience

- Price

- Convenience

- Compatibility

- Reliability

Example 3: Create a knowledge base

A knowledge base is an online content repository that contains answers to commonly asked questions, troubleshooting tips, how-to instructions, and product information.

Your knowledge base is a one-stop place for customers to go when they run into issues, saving them from having to contact your support.

Many customers are willing to help themselves, but won’t be able to if they can’t find the right information on how to resolve their problem. This is a great opportunity for creating a blog and employing SEO, resulting in improved Google rankings and increased organic traffic.

Other benefits of developing an online knowledge base include:

- Boosting employee productivity: According to McKinsey research, employees spend 1.8 hours every day looking for information.

- Reducing the pressure on customer service: A knowledge base enables you to automate the majority of routine customer service inquiries, freeing up your support team’s time to focus on more complicated cases.

- Enhancing the onboarding of new workers: When you hire new workers, you have a ready-made resource for them to use while they learn about your firm and its processes.

Example 4: Build an engaged community

By encouraging connections among your subscribers, like-minded people will meet and create relationships through your business — and you’ll become even more desirable as you deliver more value. This will increase your customer retention rate and promote engagement over time.

Finding and delivering personalized “thank you” letters to your most loyal customers (followers) can also make them feel even more important and treasured.

Finally, perhaps the most powerful tools of all that you can use are discounts and promo codes that consumers truly feel are just for them.

Example 5: Implement an effective loyalty program

Many business owners feel that client retention will follow if they have a great product or service and provide an excellent customer experience. And with this mindset, they’d be right… but often, only for a short time.

In terms of loyalty, customers owe you nothing. You must earn it continually. An effective customer retention program enables you to discover, track, and target your advertisements and campaigns to potential and existing subscribers who are most likely to become loyal, long-term income sources.

Immediately launching a customer loyalty campaign may not be necessary at the very, very beginning since the quality of the service and support will determine the retention percentage. However, it’s always worth planning ahead, and strategizing which type of rewards program you might want to use.

Types of rewards programs

- Points-based loyalty programs

- Tiered loyalty programs

- Paid loyalty programs

- Value-based loyalty programs

Key takeaways

Customer retention rate is undoubtedly one of the most important KPIs that subscription businesses should be tracking.

Even a small improvement in the ratio will lead to massive differences in the company’s revenue and customer lifetime value.

Collecting customer feedback, analyzing, and improving your product is the best way to improve retention.

What’s next?

One of the best ways to develop your subscription-based business is by using a subscription-first platform with everything you need in one place. Try our 14-day free trial, and you’ll see for yourself what a difference it makes — particularly when it comes to maximizing retention in the long run.