What is recurring revenue?

Recurring revenue is the proportion of a company’s revenue that comes from repeat purchases and recurring payments. The opposite of recurring revenue is one-time revenue, which comes from non-recurring payments which aren’t guaranteed to happen again in the future — making it harder to forecast the future.

While these repeat purchases can occasionally come from customers with a particular dedication to a specific one-time product, recurring revenue is often commonly associated with the subscription business model, the membership business model, and other similar types of business.

But why is it such a big deal? And what are its advantages? Let’s find out.

Advantages of the recurring revenue model

The main advantages of recurring revenue models go hand in hand with the advantages of subscriptions as a general concept:

- Consistency and predictability

- Fostering long-term relationships

- Makes scaling easier

Successful recurring revenue models entail high customer loyalty

Simply put, if someone is buying the same product from you over and over again throughout a long period of time, it means you’re their solution to an ongoing problem or the answer to an ongoing desire.

The longer you and your offering stay in the lives of your loyal customers, the harder you’ll be for a subscriber to give up… as long as you keep delivering. This explains why businesses built on loyalty are significantly less likely to experience high churn.

Customers often have a higher lifetime value (LTV)

By the same logic, the longer a customer is with you, the higher their lifetime value will be. Once you start building momentum and winning more and more customers over to your side, the compounding effect of this on your bottom line will become more and more evident in turn.

Building a strong foundation of recurring revenue reduces long-term risk

Cash flow is more stable with a recurring revenue model than with a non recurring revenue model. The more accurately you can forecast where you’re going to be in a few months (or even years), the easier it’ll be to decide where to allocate resources to growth initiatives and experiments.

Recurring revenue model examples

In a subscription business context, recurring revenue can come from a wide range of forms. These include when customers pay monthly for a curated box to when they’re locked in to a year-long contract for subscription based services.

Here’s some examples of the types of recurring revenue that you may be able to identify and optimize for within your own company, or plan for if you’re still looking into how to start a subscription business.

Auto renewal subscriptions

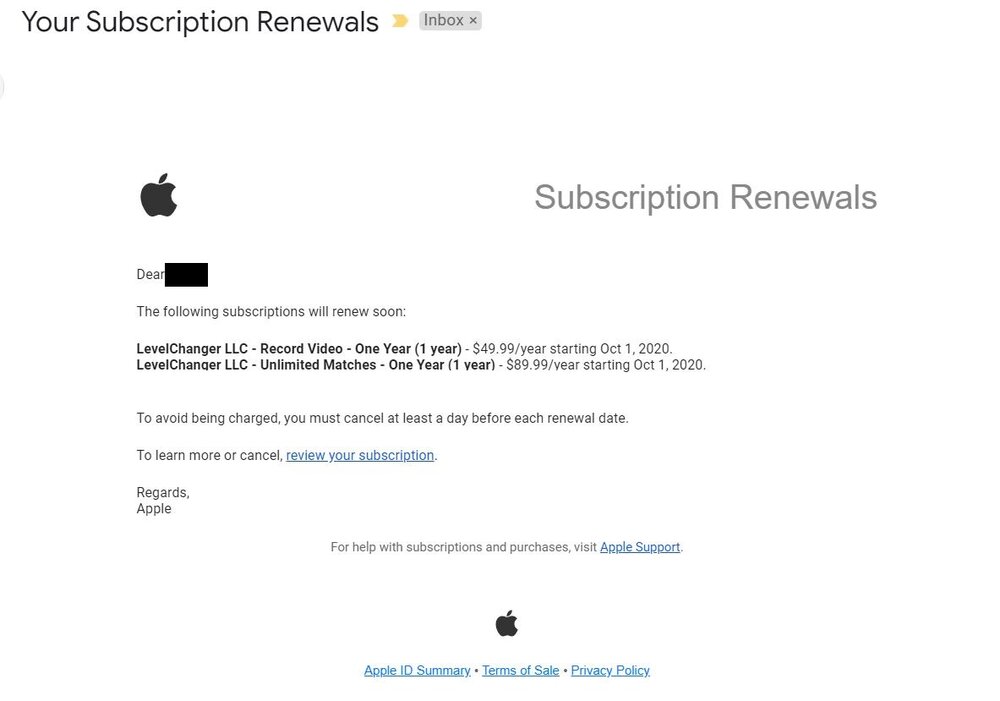

Via LevelChanger

Auto-renewal policies are a great way to create recurring revenue by locking in existing customers when they’re getting to the end of their subscription period, boosting retention while preventing involuntary churn. Customers with a demonstrated history of loyalty to your brand can be given discounts and other special offers as well to sweeten the deal – but in any case, make sure your renewal process is properly communicated to subscribers well in advance to avoid surprising them with charges they’re not prepared for before you have to resort to dunning.

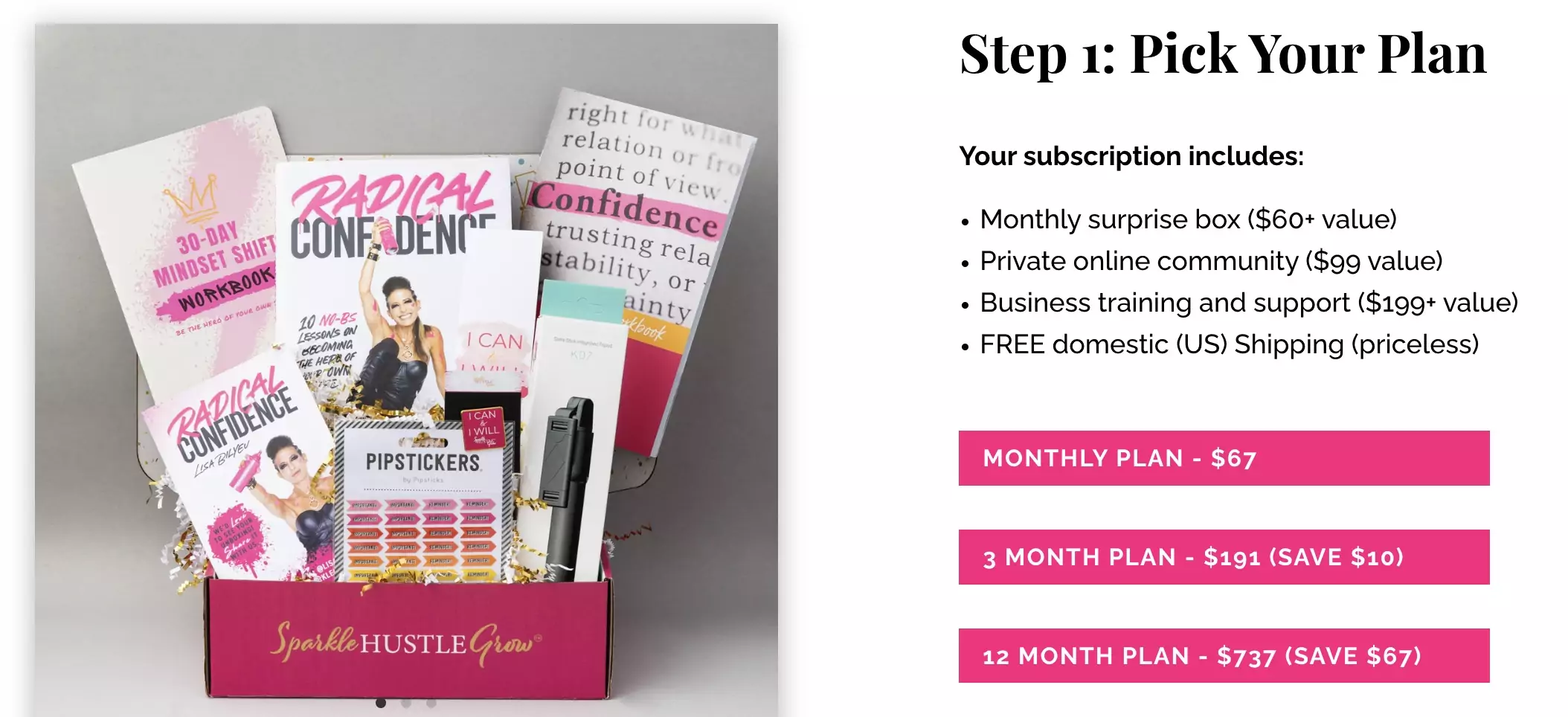

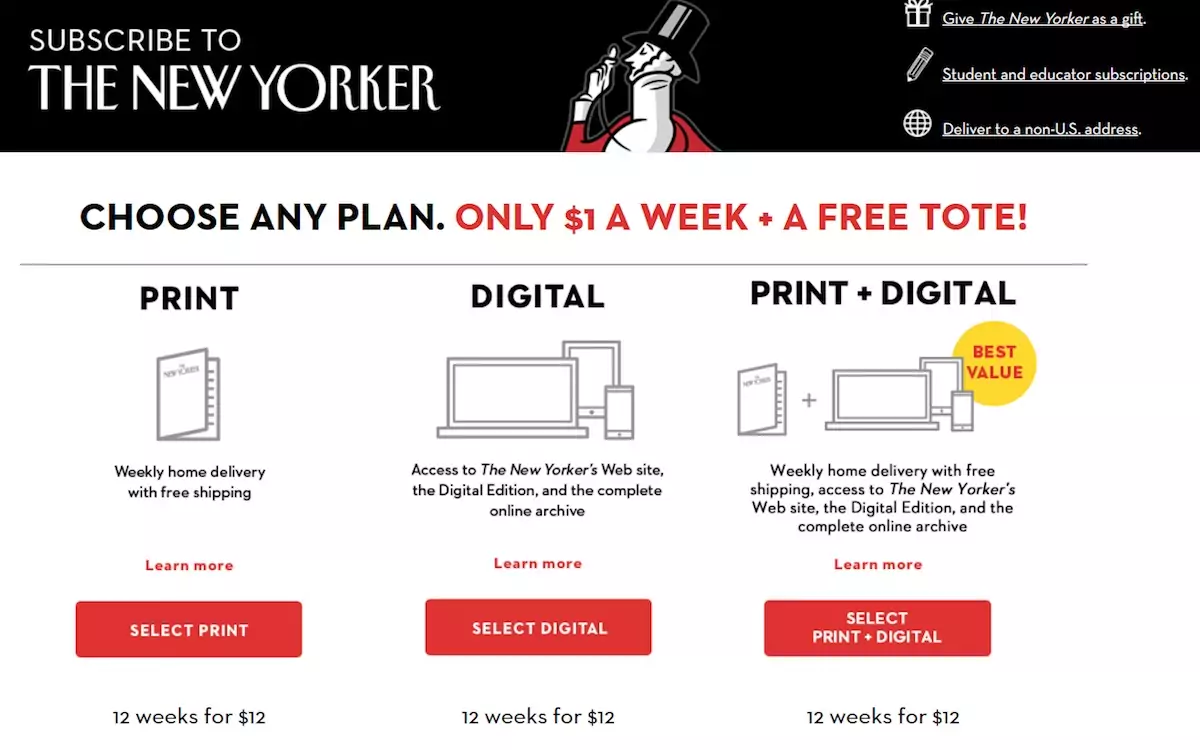

Contracts with a minimum commitment period

Contracts with a minimum commitment period are one of the most powerful sources of recurring revenue for all sorts of subscription businesses, from SaaS companies to online courses and coaching programs.

Often, business operators require customers to pay up front for the whole year, although it’s customary to give some sort of discount in return for the commitment. Minimum commitment periods can go all the way from a few months to a year or more – the longer the commitment, the larger the discount you may have to offer your customer base, however the benefit in terms of cash flow security and future income.

Upselling or cross-selling a supplementary product or service

If your main offering entails a product or service that could be enhanced by another one of your offerings, giving the option to add it as a supplementary product on a rolling monthly contract basis can be a great way to boost your monthly recurring revenue.

For example, if you sell boxes containing samples of high-end teas, you could offer the option to include a unique, high-quality accessory at a discounted price every month. Depending on your inventory situation, this could also be a good tactic to shift excess stock while still providing value through a strategic upsell.

Perhaps you’re already shifting some of these items as one time sales already? Turning them into a subscription is even more efficient, and allows you to earn recurring revenue!

Recurring revenue business model FAQs

What is the recurring revenue model?

Recurring revenue business models focus on creating stable and predictable revenue streams that are likely to continue to exist in the long term. There are many ways to generate recurring revenue, including starting a subscription box, creating a digital membership, and more.

What is recurring vs nonrecurring revenue?

Recurring revenue’s inherent predictability allows business operators to forecast the company’s financial future more accurately. Non-recurring revenue, on the other hand, is revenue that a business generates from one-time sales, rather than recurring sales. Businesses that focus on non-recurring revenue will end up having to spend more time focusing on acquiring new customers to ensure growth, or maintain stability at a minimum.

How do you calculate recurring revenue?

How to calculate Monthly Recurring Revenue (MRR)

To calculate your monthly recurring revenue, simply multiply your monthly Average Revenue Per User (ARPU) by the total number of subscribers you have.

How to calculate Annual Recurring Revenue (ARR)

To calculate your annual recurring revenue, first calculate your monthly average recurring revenue, then multiply it by 12.

Why is recurring revenue better?

Recurring revenue allows you to manage your cash flow more efficiently, forecast your future revenue more accurately, and scale your business mode effectively. In a subscription business context, an increase in recurring revenue is also often an indicator that your customer retention rate is also increasing – and retention is cheaper than customer acquisition, after all.

In summary

Recurring revenue is the foundation of a successful subscription business. The more of it you secure, the lower your operational and financial risk will be. While there’s no guarantees that any given recurring revenue stream will be permanent, as you make them stronger through careful optimization, you’ll find yourself with a more predictable cash flow and an overall more resilient subscription model.