What is customer lifetime value?

Customer lifetime value (CLV or LTV) refers to the total income you can expect from a single customer throughout the course of your business relationship, and is often presented as an average of all customers either business-wide or within a particular segment.

Source: Reverbico

Why is customer lifetime value an important metric for a subscription-first business?

CLV is one of the essential KPIs for subscription businesses because it provides you with a customer-centric view, guides some critical marketing and sales decisions, and helps you analyze the effectiveness of the business in terms of acquisition, retention, upselling/cross-selling, and support initiatives. Let’s unpack the idea behind these examples.

CLV allows making better decisions on customer acquisition costs

Your customer acquisition cost (CAC) is the amount of money you spend to attract new customers. Analyzing CAC in conjunction with customer lifetime value is a standard method for determining if a business is functioning efficiently, with the ideal CAC:LTV ratio being around 3:1, which looks high, but accounts for the fact that customer lifetime value doesn’t factor in any operating costs.

Source: Klipfolio

When you know how much you can expect to make from a typical customer, you can adjust your spending to add value to each customer’s experience, optimize profitability, and grow your subscription business while also attracting high-value customers.

Measuring customer lifetime value makes identifying issues and boosting customer loyalty easier

As you analyze your metrics over time, you’ll find some patterns that paint a picture of your ideal customer’s behaviour. Once you commit to setting CLV as a priority in your business, you’ll start to identify every unpleasant trend (i.e. where that behavior starts to deviate) and develop actionable steps to combat them.

If you find your CLV to be consistently low, examine these 3 aspects of your operations – there may very well be some low-hanging fruit that you can easily address.

- The strength of your customer support

- The value of your customer retention program

- The level to which you’ve created a fully integrated customer journey

This is just some initial food for thought… we’ll discuss some more examples of potential areas for improvement later in this article.

How to calculate customer lifetime value

Subscription-based businesses have different business models compared to their traditional, transactional counterparts. Notably, they tend to have higher CLVs because they focus on developing long-term loyalty and minimizing voluntary and involuntary churn.

The customer lifetime value formula for the non-subscription business model is as follows.

CLV = Average order value * the number of orders in a given period * the average customer lifespan.

You can also take expenses into account by multiplying your CLV by your profit margin.

It’s not quite the same process for subscription businesses, though.

Calculating customer lifetime value for subscription businesses

The variables are slightly different, but in the end, you will get the same metric.

- Determine your average revenue per user (ARPU):

To calculate average revenue per user, take all your recurring earnings over a specific period (MRR or ARR) and divide it by the number of active subscribers who paid for your services/products during that time. - Divide it by your churn rate:

The basic formula for customer churn calculations is as follows:

(Total customers who cancelled in a certain period/Total customers you had at the beginning of the same period) * 100 (convert to percentage).

We’ve written more about churn rates here if you want to dive deeper into the subject. - Calculate your Customer Lifetime Value:

Now you have the inputs, use this formula to calculate your customer lifetime value:

CLV = ARPU / Churn

Here’s an example: Let’s say that you offer three subscription plans. The lowest tier costs $10/month, and you have 50 people subscribed. The medium tier costs $20/month with 40 subscribers, and the large tier costs $50/month with 15 people in.

Your monthly recurring revenue will be $2,050. In order to get your ARPU, divide it by the number of subscribers (2,050 / 105 = 19.52).

Assuming a monthly churn rate of 5%, you can add everything into the CLV formula.

$19.52 (ARPU) / 5 (churn rate) * 100% = $390.60 (CLV/LTV)

This means the average customer will bring $390.60 into your business over the duration of their relationship with you.

Historical customer lifetime value vs predictive customer lifetime value

It’s also worth touching on two other models of approaching your CLV: historical CLV and predictive CLV.

The historical model uses the AOV to calculate CLV, and relies on past data indicating how much a customer has spent buying products from the company over a certain period of time, without any assumption that they will continue to stay subscribed in the future.

The predictive model, on the other hand, uses a machine learning-driven process to analyze historical data and algorithmically forecast the behavior of current or new customers.

Results gained from the predictive model can be very useful when forecasting cash flow for your business… but that’s another topic.

Back to the matter at hand, now that you know why LTV calculation is important and also how to measure it, it’s time to enhance it.

How to improve your CLV?

You can improve your CLV by reducing churn, working to extend the duration of your customer relationships, or encouraging your subscribers to commit to a minimum subscription duration or buy more expensive plans. While that may sound obvious, even then, what can you do to improve all of these simultaneously? Let’s find out.

Tip 1: Collect data-driven rewards

Starbucks was an innovator with its Starbucks rewards program. With this program, customers use its app to collect rewards for every purchase, which can then be redeemed for free food and drink. Payment must be done through the app, producing even more user data for Starbucks to use in personalizing its service and better understanding its customers evolving needs.

Collecting information is absolutely crucial, which is why it’s crucial to run your business with a subscription ecommerce platform that offers tracking codes, scripts, and analytics dashboards specifically for that reason. Weaponize every feature you can get your hands on, because the bigger your arsenal, the quicker you’ll be able to identify trends and seize opportunities for your subscription business.

Tip 2: Support a charity

TOMS’ ‘One for One’ campaign, which survived for 15 years before its retirement during the pandemic, is an excellent example of customer understanding. Every time someone bought a pair of TOMS shoes, the brand would donate a pair to someone in need. It refers back to the company’s brand principles and admits that its consumers are motivated by their desire to do good rather than discounts and rewards. It demonstrates that not all client retention strategies must rely on monetary rewards for your customers.

There are some wonderful people out there willing to help the Earth. As an example, if your product appeals to those concerned about climate change, consider donating some of your money to a charity that plants trees. You’ll both gain karma and, more tangibly, enhance customer relationships with your brand.

Tip 3: Upsell and cross-sell

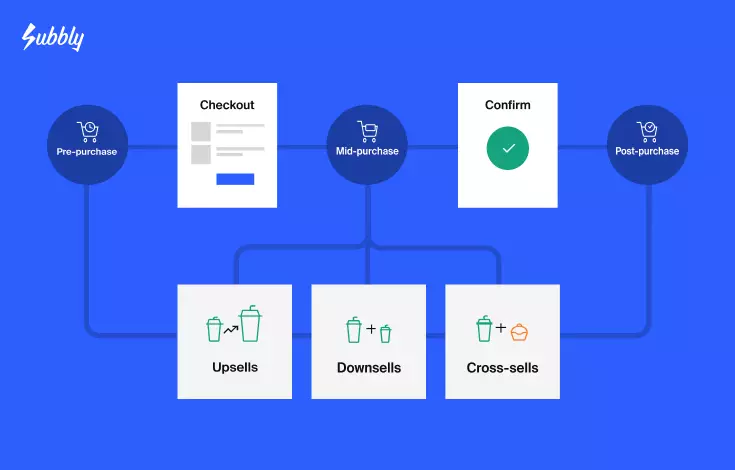

Upselling and cross-selling are strategies designed to encourage customers to buy more expensive or multiple products or services at once instead of purchasing only what they initially came to you for.

When you upsell an existing customer, you are offering them a comparable but better product. While the price might be a bit higher, an existing customer will already be primed for action. Even generally speaking, it’s far easier to sell to existing customers than bring in a new one.

Downsells are often referred to interchangeably with cross-sells (you would never ever want to sell a cheaper product instead of the original, right?), but they’re not the same – downsells specifically involve a lower-priced offering, whereas a cross-sell could entail a product of the same or different price range.

This flowchart is just a simple example of how a sales funnel can contain multiple opportunities at various stages of the purchase journey.

A sweet yet nutritious treat might be cross-sold to a customer who is purchasing a healthy drink, for example. Cross-selling frequently directs customers to things they would have purchased anyways. By displaying them at the proper time, subscription businesses assure they make the sale then and there, before the customer looks to a competitor to fill the gap.

Brands like Amazon and McDonald’s are examples of companies that use the upsell and cross-sell method extremely well. Amazon will offer you related products and bundle them into a group price, as depicted below.

Source: Neil Patel

McDonald’s also offers small upsells in the form of those delicious apple pies that help boost the overall average order value and CLV too.

Subscription-based companies may increase their average order and customer lifetime value by deploying strategically placed upsell and cross-sell offers encouraging customers to switch to an annual billing cycle, which could come with its own set of benefits.

This strategy works because even a small increase in order value over time leads to increased CLV and overall revenue. Consider the example of the McDonald’s apple pie – and note that while McDonald’s isn’t officially a subscription business, its addictive properties and reputation for consumer loyalty demonstrate its commitment to maximizing CLV, which makes it a relevant example in this context. While adding a $1(ish) item to each transaction isn’t much on its own, over time, each time a customer comes back, the smaller amounts add up to substantive revenue and help increase total CLV across the board.

Tip 4: Enhance the user experience by creating a customer journey map

A customer journey map is a representation of a customer’s interaction with a business. It gives insight into the demands and obstacles which stimulate or restrict behavior of potential customers. Approaching the business relationship this way enables companies to optimize the customer experience, resulting in increased customer profitability, retention rate, and CLV.

If you’ve never seen a customer journey map before, here’s an example:

Source: HOTC

While you create this, focus not only on what steps your customer needs to take in order to subscribe but also what happens after that too. You can ask yourself these questions when making the map:

- Does my traffic flow from Instagram ads to the right page?

- Do I need to create dedicated landing pages for any specific traffic sources?

- Is it easy and intuitive for visitors to navigate around my website?

- Do I need to include more payment options?

- What might people be thinking during each step of the experience?

And you don’t have to guess the last one – you can run a customer experience test session with friends or family, or even do it yourself and really get into the mindset of the people you’re selling to. As thoughts come up throughout the process, identify any sources of friction that might occur during the process of ordering. If your offering looks amazing but your company just doesn’t look established enough, for example, you could add social proof in crucial areas, such as your product pages or the cart page. These can include:

- Testimonials

- Badges

- Certificates

- Reviews

Key takeaways

- Customer lifetime value measures the average customer’s revenue generated over their entire relationship with a company.

- Comparing CLV to customer acquisition cost is a quick method of estimating a customer’s profitability and the business’s potential for long-term growth.

- Looking at CLV by customer segment may offer expanded insights into what’s working well and what isn’t working as well for your company.

- You can improve CLV by increasing the customer retention rate, upselling and cross-selling, better understanding and improving the customer journey/experience.

So, what was the idea again?

To summarize, your business is mostly about making something wonderful, but you don’t have to just hope that people will purchase it. It’s about knowing the metrics that go into the objective definition of success, which can vary greatly from company to company and business model to business model.

Every metric should be analyzed within the context of your business, but the general rules can apply, like aiming for an LTV/CAC ratio of around 3-4% and reducing churn as much as possible. When properly configured, you’ll be able to get a more clear picture of where your company is today and respond appropriately to your opportunities for long-term growth.

As a subscription-first business, you’re more likely to have higher CLVs and that means more space for CAC than your non-subscription competitors. Making the most of this core truth will be easier than expected with the right all-in-one platform by your side (like Subbly). Your first two weeks are on us, so you can see for yourself. – try Subbly for free today!