What are the benefits of using a subscription revenue model for your business?

Customers are embracing subscription services for convenience, cost-effectiveness and timely access to goods and services. The recent rise of subscription businesses has also been driven, at least in part, by business owners recognising the revenue and other benefits of a subscription business model.

While the physical storefront has long dominated the retail industry, the shift towards the subscription revenue model and its correlated benefits cannot be overstated. As experienced by many businesses which have (successfully) figured out how to start a subscription box business, some of the most noteworthy benefits include more ease in generating predictable subscription revenue, simplified forecasting, scalability and reduced churn of customers, all of which amplify your final recognized revenue.

Easier forecasting due to predictable subscription revenue and a recurring payment cycle

Subscription revenue forecasting is the projection of recurring revenue that a business is expected to generate over a certain period. Forecasting is extremely useful as it helps inform business decisions, planning and management of new and existing subscribers.

A subscription revenue model means regular, recurring payments are being made to your business by your customers. This means predictable revenue and consistent cash flow, making it easier to forecast your recurring subscription revenue.

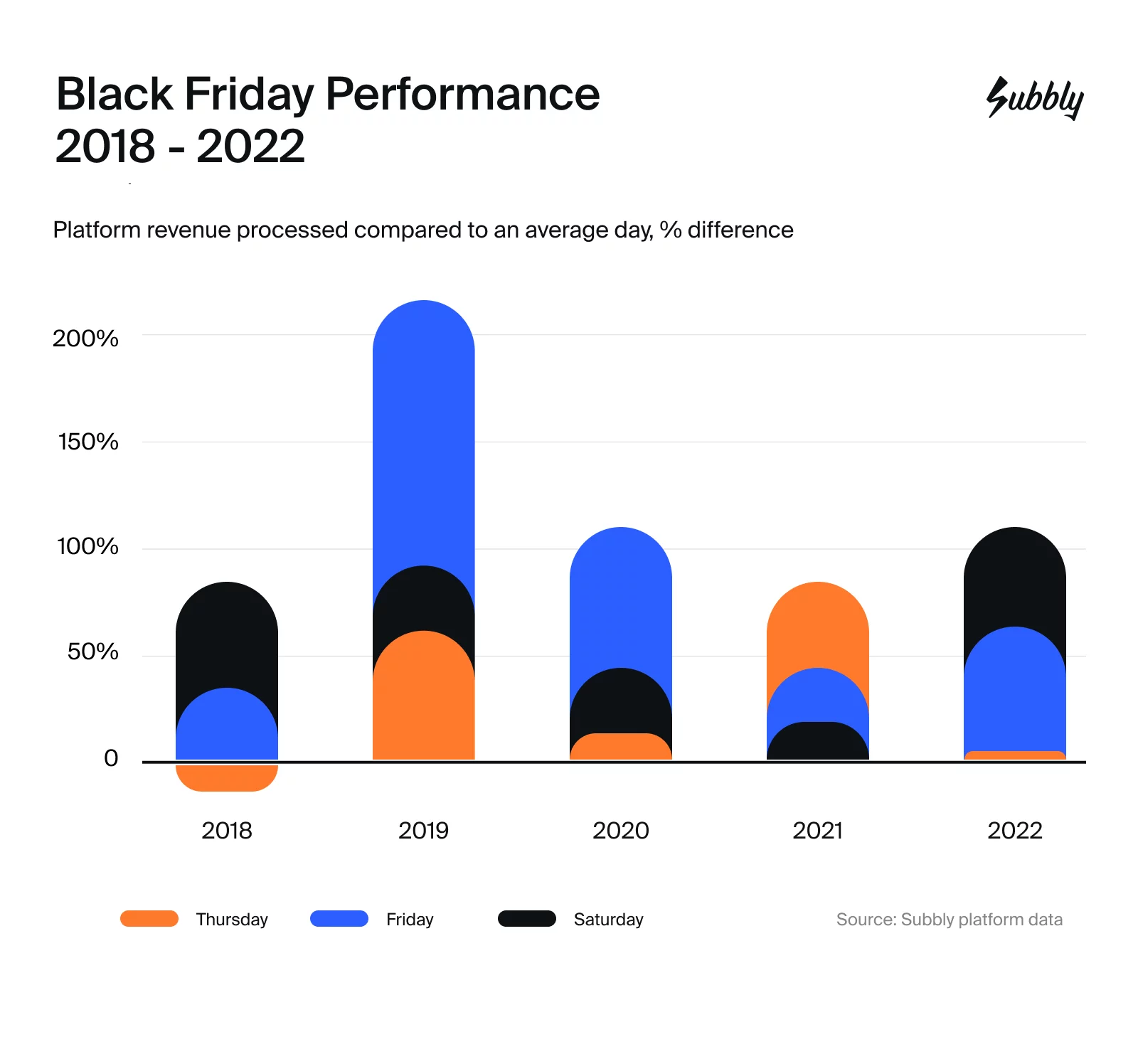

The Black Friday weekend is a great example of this – with a huge surge of activity seen consistently across all Subbly merchants each and every year.

Easier to scale

Easier to scale

The traditional business model is constrained by having to process individual invoices and sales. This is time-consuming and high effort. Businesses selling physical products also face additional revenue challenges, as they have to factor in fulfillment, logistics, and shipping costs to customers.

Subscription companies are easier to scale on demand. A subscription revenue model means the entire purchasing and fulfilment process can be automated and streamlined, as most existing customers are receiving similar, if not the same, products and services. For example, SaaS companies offer customers a digital subscription to one or several platforms and tools. Some of the best known SaaS companies include Shopify, Canva and Adobe, and all of them drive a large portion of their revenue with subscriptions.

One of the other contributing factors to an easier scaling process is the emphasis on customer lifetime value (LTV). This is because the costs of customer retention are lower than acquisition costs. A subscription business model focuses on fostering existing customer relationships, thus decreasing acquisition costs and increasing potential revenue.

Easier to build long term customer relationships

The majority of customer churn is preventable through offering subscribers the right support. Businesses are increasingly turning to subscription revenue models to achieve better customer relationships, customer retention and, by extension, customer acquisition.

When customers subscribe to your product or service, retention is easier because they are already invested in your offering. The priority, then, needs to be on providing customers with an exceptional experience to ensure they retain their subscription, thus securing ongoing revenue.

Subscription companies generate a wealth of data that you can use to inform your business decisions, including your approach to customer relationships, marketing, and product or service strategies. As soon as a customer enters into an agreement with your business, your data profile of that person starts to be built. This profile becomes more complete the longer that customer stays with you, meaning you can tailor your services to deliver a more personalised experience and optimize your revenue generation strategies.

How to forecast subscription revenue

A subscription revenue forecast is used to project how much recurring revenue a subscription business will generate during a certain period. Subscription revenue forecasts help businesses with budget planning and strategy decisions.

However, it can be challenging to conduct an accurate revenue forecast in the beginning, particularly as a new subscription business. Subscription revenue forecasting requires the consideration of factors including annual and monthly income, customer churn, customer lifetime value, revenue recognition, and how much revenue be expected from each customer.

Fortunately, there are metrics to help you with accurate subscription revenue forecasting.

Metrics used in subscription revenue calculation

Subscription metrics are an important part of accurate subscription revenue forecasting and can be used to determine how your business is performing. Metrics provide data, and the more data subscription businesses have on hand, the better decisions they will be able to make.

Annual recurring revenue (ARR)

ARR = (total contract value) * (12 / duration of contract in months)

ARR is used to determine how much recurring revenue a business is projected to make over a 12 month period. This metric is ideal for subscription companies with long-term existing customers who pay up front for a 12-month, or longer, contract. This also contributes to how you recognize revenue, explained below.

Monthly recurring revenue (MRR)

MRR = (average monthly revenue per customer) * (total number of customers)

MRR can be used to calculate how much revenue a subscription business can expect to generate on a monthly basis. The MRR is the average revenue earned per customer, per month, multiplied by the total number of customers.

Customer churn rate

Customer churn rate = (lost customers in a given time period / total customers at the beginning of the time period) x 100

Churn rate measures the number of customers who cancel their subscription or membership in a certain time period. It does not factor in the dollar value of those memberships.

There are two types of churn which impact your revenue:

- Voluntary churn occurs when customers choose to end their subscription

- Involuntary churn occurs when a customer’s subscription ends without active input (e.g. automatic expiry)

Average revenue per user (ARPU)

ARPU = MRR ÷ number of active customers

The ARPU is the amount of revenue received from each customer within a certain period. It is useful for forecasting well into the long-term, as well as creating yearly reports for internal purposes and future planning.

Customer lifetime value (CLV)

CLV = (ARPU * average customer lifespan)

The CLV determines how much paying customers will spend with your business over the lifetime of their contract. To be able to calculate this, subscription businesses need to know both the average revenue per user as well as long on average customers use their service before cancelling their membership.

How to calculate revenue recognition

It’s also important for subscription businesses to decide how they determine subscription revenue recognition. Subscription revenue recognition is all about when money has been earned, not just collected — i.e. recognized revenue. So how do you recognize revenue?

Let’s say you offer an annual subscription based service for coffee capsules. The annual subscription price is $240. To find your recognized revenue, you divide $240 by 12 months. This means your revenue recognition is $20 per month. While you’ve been paid the $240 at the start of the contract, you haven’t yet earned that money. If unforeseen circumstances led to the contract being cancelled before the 12 months were finished, your business would owe that money to your customers.

The other side of revenue recognition is deferred revenue. While deferred revenue sounds negative, it’s actually the money which is money received in advance from customers for a product or service that will be delivered in the future. It’s important to keep a deferred revenue account alongside your revenue recognition as part of your revenue projections.

How to move to a subscription revenue model

If you’re wondering when the right time is to move to a subscription revenue model, the answer is most likely yesterday. The sooner you incorporate subscription services into your business model, the sooner you can start reaping the benefits.

Here are a few things to take into account when you’re planning your move to add a subscription revenue model to your business:

- Get to know your new customers – Make sure you understand your target audience ahead as part of developing your subscription model. This involves research into the interests of your customers, high traffic keywords, etc, so you can be sure you’re maximizing revenue.

- Understand your competitors – Conduct thorough research into the other players within your niche and how they are appealing to customers. Even if your idea is unique, make sure not to ignore the companies with a similar offering. This will help you determine your price point and differentiation strategies so you can communicate them to customers.

- Develop an idea – The possibilities for subscription services are virtually limitless. Subscription boxes, content libraries, exclusive membership or unlimited access – whatever your idea, taking the time to develop it properly will result in higher revenue.

- Plan logistics – You have your idea, how are you going to get it into the hands of your new customers? This involves shipping physical products or platform management for service-based offerings, for example.

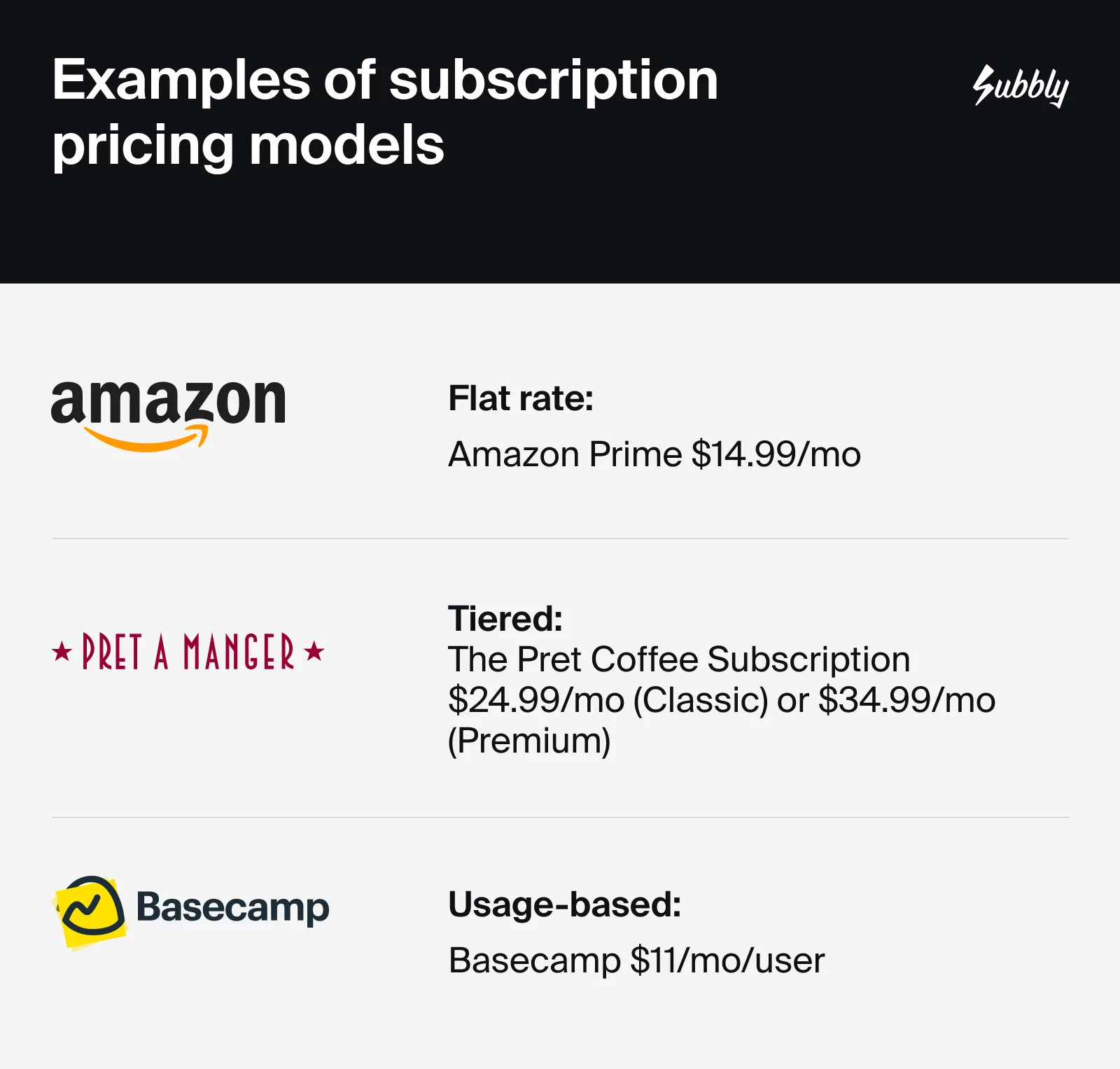

- Determine your subscription pricing strategy – While it can be tempting to price your offer as cheaply as possible to appeal to customers, there are many more effective strategies to determine your ideal price point and maximize revenue. Your subscription pricing strategy could also entail tiered pricing model options and different membership levels to appeal to different groups of customers

- Make a sample box – Create a mock-up of your subscription box, product or service as it will be received by customers. This will help you perfect the experience for your new customers. What are the little touches you’re adding to demonstrate value to your customers? Be mindful that any added extras will have an impact on your revenue, but the investment could be worth it in the long term.

- Marketing plan – How are you planning to tell new customers about your subscription product or service and drive revenue? While this could start with word of mouth, you may also consider social media marketing, influencers, or paid channels to attract customers.

- Post-launch analysis – Once your subscription offering is ‘on the shelves’ and in customers’ hands, a post-launch analysis will help you continue to optimize your business strategies and revenue. For example, you may find a particular marketing channel is better at drawing in new customers and you may choose to capitalize on that.

Key takeaways

A large and growing portion of businesses are choosing to embrace a subscription based model as a method of diversifying their revenue streams, strengthening their organization with predictable revenue growth and meeting the evolving needs of their customers.

Whether you’re considering adding a subscription revenue model to your existing business or starting a subscription business from scratch, anyone can tap into the benefits to your organization and your customers alike.

With the right metrics and performance measurements, alongside a thorough subscription revenue adoption plan, you’ll be able to more efficiently recognize revenue, maximize your recurring revenue growth opportunities, and position your subscription model business for success. An all-in-one subscription-first platform like Subbly is one of the best ways to achieve all these goals – start your 14-day free trial today and experience for yourself.

Easier to scale

Easier to scale